Do Green Card Holders Need to Pay Taxes?

A green card holder with tax questions? Important question: “Do Green Card Holders Pay Taxes?” The guidelines can be perplexing for this prevalent worry. A good attorney can help. This essay will simplify green card holder taxes so you know what to do. Understanding tax regulations and staying on track with your taxes can be made easier with a skilled attorney.

Quick Summary:

The articles cover essential aspects related to green card holders, taxation, and FBAR requirements. They emphasize understanding the distinction between tax residency and nonresidency, highlighting the impact of U.S. tax laws on green card holders and providing guidance on filing taxes. Additionally, the articles delve into the FBAR requirements for California green card holders, outlining potential consequences of noncompliance, and conclude by encouraging readers to seek assistance from legal advisors, specifically inviting them to contact El Camino Inmigracion lawyers for a free consultation.

What is a Tax Resident Versus a Nonresident?

Understand the difference between a tax resident and a nonresident for tax purposes.

Tax residents, like U.S. citizens or Green Card holders, pay taxes on their worldwide income to their home country. Even without a citizenship, a Green Card makes you a US tax resident.

However, a nonresident is someone who doesn’t qualify for tax residency. Most U.S. nonresidents pay taxes on their domestic income, not their worldwide income.

Tax resident or nonresident status determines which income is taxable and which tax forms must be filed. This is usually determined by immigration status and substantial presence. A lawyer can clarify your position based on your situation.

How Does the U.S. Tax Law Affect Green Card Holders?

U.S. tax legislation affects green card holders’ duties and commitments. Green card holders must report their global income to the IRS as tax residents. U.S. tax returns, usually IRS Form 1040, must be filed annually according to deadlines and reporting requirements. Green card holders file taxes using their Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN).

Green card holders pay U.S. taxes on all income. The Foreign Earned Income Exclusion (FEIE) and tax treaties may reduce foreign income taxes. Green card holders must be aware of tax treaties with their home country, which can affect tax liability. Since 2012, IRS Form 8938 requires disclosing particular foreign financial assets such bank accounts. Green card holders may be eligible for exclusions or deductions, such as the Foreign Tax Credit (FTC), to offset foreign taxes.

How Do Green Card Holders File Taxes?

Green card holders follow a specific process when filing taxes in the United States. Here’s a step-by-step guide on how green card holders can file their taxes:

- Gather Necessary Documents: Collect all relevant financial documents, including W-2 forms, 1099 forms, and any other income-related documents.

- Choose the Correct Tax Form: Green card holders typically use IRS Form 1040 for individual income tax returns. The choice may vary based on specific circumstances, such as income sources and deductions.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): Use your Social Security Number (SSN) for tax reporting. If you are not eligible for an SSN, you can apply for an ITIN and use it on your tax forms.

- Report All Income: Include all sources of income, both within and outside the United States. This encompasses wages, interest, dividends, rental income, and any other income.

- Consider Foreign Tax Credits: Green card holders may be eligible for foreign tax credits if they paid income taxes to another country. This can help avoid double taxation.

- FBAR Filing (If Applicable): If you have foreign financial accounts with an aggregate value exceeding $10,000 at any time during the year, file the Foreign Bank Account Report (FBAR) electronically through the BSA E-Filing System.

- Check for Tax Treaties: Be aware of any tax treaties between the U.S. and your home country, as these may affect your tax obligations and potential credits.

- Explore Deductions and Credits: Investigate available deductions and credits to optimize your tax situation. Common deductions include mortgage interest, student loan interest, and charitable contributions.

- File on Time: Ensure your tax return is filed by the deadline, which is typically April 15th. If needed, file for an extension to avoid penalties.

- Consider Professional Assistance: While many green card holders can navigate the tax filing process independently, seeking assistance from tax professionals or certified public accountants (CPAs) can provide guidance, especially in complex situations.

By following these steps and staying informed about changes in tax laws, green card holders can fulfill their tax obligations and optimize their financial situation while avoiding potential penalties and legal issues.

What Are The Foreign Bank Account Report (FBAR) Requirements for California Green Card Holders?

For California green card holders, understanding Foreign Bank Account Report (FBAR) requirements is important to stay compliant. Green card holders, considered resident aliens, face specific tax obligations, including the obligation to file an FBAR. This report, officially known as FinCEN Form 114, must be submitted electronically through the BSA E-Filing System.

The FBAR applies to U.S. residents with foreign financial accounts exceeding $10,000 at any point in the taxable year. It is due annually on April 15, with a possible extension until October. Failure to file can result in severe civil and criminal penalties.

Green card holders, even those with assets in their home country, must file the FBAR to disclose offshore accounts.

What Are The Consequences of Not Filing an FBAR?

The consequences of not filing an FBAR (Foreign Bank Account Report) can be severe and may include:

- Civil Penalties: Non-willful violations can result in fines of up to $10,000 per account per year. Meanwhile, willful violations may lead to higher penalties, potentially reaching $100,000 or 50% of the account balance, whichever is greater.

- Criminal Penalties: Willful noncompliance may result in criminal prosecution. On the other hand, criminal penalties can include substantial fines and imprisonment.

- Risk of Asset Forfeiture: Willful failure to file an FBAR may expose individuals to the risk of forfeiting assets associated with the undisclosed accounts.

- Loss of Foreign Funds: Noncompliance can lead to the loss of funds held in foreign financial accounts, as penalties can be enforced through the seizure of these funds.

- Impact on Immigration Status: Green card holders and other non-U.S. citizens may face immigration-related consequences, including the potential loss of immigration status or denial of future immigration benefits.

- Complications with Citizenship: Noncompliance with tax obligations, including FBAR filing, can complicate the process of obtaining U.S. citizenship.

- Legal Challenges: Individuals failing to file an FBAR may encounter legal challenges and may need to address the situation through legal proceedings.

Ask Us About Green Card Holder Taxes

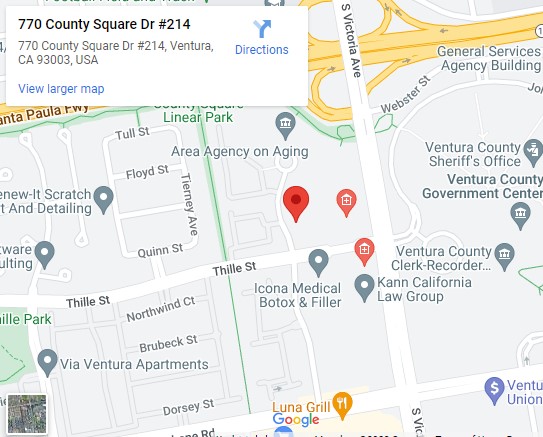

If you’re not sure how to file your taxes as a green card holder or if it seems complicated, getting help from legal advisors is a smart move. They can guide you through the process and make sure you don’t face any big problems. Remember, your actions with taxes can have serious effects, so it’s best to get the right advice. If you have questions or need help, feel free to call El Camino Immigration lawyers for a free consultation. We’re ready to help you. Get in touch today!